Pay by Link: Benefits and How to Create One

Getting your clients to respond and pay your invoices in a timely manner is a challenge nearly every building and design professional has to face. Many clients have a tendency to drag their feet on paying your bills, often requiring several reminders to get them on track.

One easy way to make it far more likely to get your invoices paid on time is to make them more convenient to pay. Equipped with an online payment solution that offers payment links, you can make paying your invoices as easy as clicking a button.

Here we’ll outline the advantages of using payment links for building and design professionals, the areas you can offer online payment options, and how adding ClientPay to your repertoire allows you to maximize their effectiveness in growing your business.

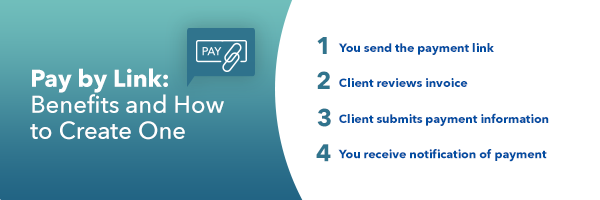

What is a Payment Link

Some online payment solutions provide their users with a unique payment link. When clicked, the payment link sends the user to a secure payment page, where their clients can enter their payment data to pay the user for a good or service. Some payment pages can also be customized with the business’ information, such as their logo, address, and contact information. This can help establish to their customers that this page is associated with their business, so they can rest comfortably knowing their payments are going to the right place.

One of the primary benefits of a payment link is that it gives customers a safe and convenient way to pay an invoice online, using a credit card, debit card, or other forms of electronic payment. Many of today’s customers prefer to pay their bills via electronic means over traditional forms of payment, like checks or cash. It’s in the best interest of any business today to provide their customers with the most popular and modern forms of payment options.

Where You Can Utilize Payment Links in Your Business

Another great benefit of using payment links is their versatility—you can place a payment link in a variety of locations throughout the lifecycle of your client relations to make it convenient and easy for your customers to access them and send a payment off for your services. Here are a handful of examples of how you can use payment links in your business:

Email Invoice

Email is a fantastic way to take advantage of payment links. You can email your customers notifying them of your upcoming invoice, complete with all the line items outlining your services, and include a convenient link for them to send a payment for the invoice. By presenting the bill and providing a payment link, you can encourage your clients to take care of the payment right away, reducing the chance that they’ll delay or avoid payment altogether.

Website

A no brainer location for your payment link is your business’s website. You can place this link in an easy-to-find location, such as your homepage. When the time comes to make a payment, you can easily direct your customers to visit your website to click on your payment link and submit a payment.

QR Code

For the uninitiated, a QR code is a pattern of squares generated by a computer program that can be scanned by smartphone cameras and other imaging devices. When scanned, the QR code directs the users to a particular website, whether it be for shopping, reading a restaurant menu, or even making a payment.

QR code payments experienced a revival among businesses during the pandemic due to its contactless nature. A QR code eliminates the need for customers to hand over their credit card information or payment data, and allows them to make a payment directly with their device. The best online payment solutions allow you to generate a QR code that will lead your customers directly to a secure payment page when scanned. You can easily place these codes on your website or your emails, or even on a physical invoice to allow more traditional clients the chance to experiment with faster, more modern forms of payment.

Text Message

Recent software innovations have allowed professionals to text their customers a payment link directly to their phones. Similar to email invoicing, text message payment links are as simple as drafting a message from your phone with the invoice and including the payment link within the message. There are even certain software solutions that can handle this style of invoicing on your behalf.

What are the Benefits of Using Pay by Link, and is It Worth It?

The best thing you can do to help grow your operation and become more profitable is to make it extremely easy for clients to pay their bills. The more hoops they have to jump through to pay you, the less likely it is that they’ll do so in the first place. Give your clients fewer excuses to leave a bill outstanding by giving them a payment link that they can easily access and pay.

Perhaps the greatest appeal of payment links is how little legwork it takes to get started. Creating payment links doesn’t require any technical expertise since it’s only as difficult as copy and pasting a link. Not only that but they work well for professionals no matter their preferred fee structure.

On the subject of simplicity, payment links also serve as a way to automate part of your bookkeeping. Rather than have to mail an invoice and then manually update your financial reports everytime you receive payment, you can skip multiple steps of your billing process by simply sending the invoice digitally, allowing your clients to pay it online, and eliminating the bookkeeping task because the technology solution you’d be using to process payments would automatically update your financial records for you.

Payment links are also a service you can market to clients as convenient and secure for all parties involved, further increasing your reputation as a client-centric business. Essentially, the more valued your clients feel is a greater chance you have of gaining repeat business and referrals to launch new projects and partnerships.

For building and design professionals searching for advantages in an increasingly competitive market, the benefits of online payments (and specifically, payment links) far outweighs the minimal effort needed to deploy them.

How ClientPay Maximizes the Effectiveness of Payment Links

Creating a ClientPay account is the easiest way to be certain that your payment links are being used in a manner that propels your business beyond the industry standard for billing and earning.

In addition to providing you with the payment links, ClientPay creates secure payment pages which include your business name and contact information for a professional look and feel, whereas on your own you may be redirecting clients to a third-party site without reliable security.

When you open a ClientPay account, you’ll also gain access to even more unique features, like Quick Bill and Scheduled Payments, plus reporting tools, A/R dashboards, and an in-house support team.

Why wait when you could be promoting a payments service to clients that exceeds their expectations? Add ClientPay to your business and start using an online payment solution that helps your business stand out among the rest, beginning with custom payment links. Schedule a demo today!